REALISTIC LINX FUNDING

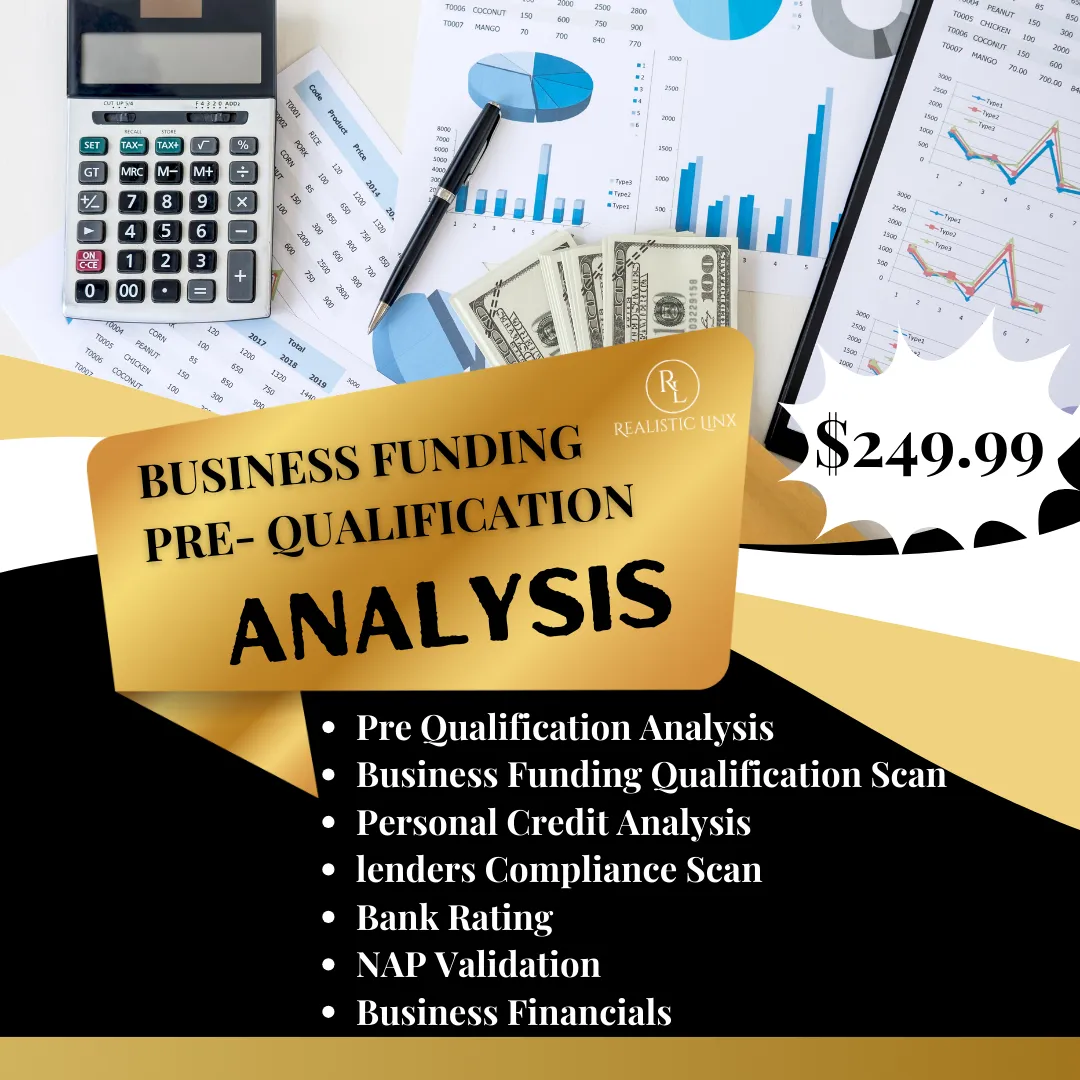

BUSINESS FUNDING PRE - QUALIFICATION ANALYSIS

Ready to Secure Business Funding?

Let’s Make Sure You Are Fundable & Bankable

& In The Best Position For Approvals!

To Start your Business

Grow your business

Scale your business

At Realistic Linx Funding we understand that getting funding can be difficult for business owners and entrepreneurs.

We often hear from entrepreneurs who are unsure where to begin their search for funding & not knowledgable of the

pre- qualifications & under writing guidelines which causes denials.

At Realistic Linx Funding we understand the challenges business owners face. Whether you need to cover unexpected expenses, payroll , marketing , operational cost , invest in growth, our funding options provide you with reliable solutions.

Strategic & Creative Financing

Credit Card & Capitol Stacking

0% Interest Rates

Term Loans ,

Working Capitol ,

Line of Credit

Ensure Your Business is

Fundable & Bankable

&

In Position with our

Business Funding

Pre- Qualification Analysis

Our Business Funding Pre-Qualification Analysis

offers a comprehensive assessment of both your personal credit and your company's financial health, providing a clear picture of your readiness to secure funding & become fundable & bankable.

By evaluating key financial metrics, we identify the financing options for which your business is most likely to qualify. This analysis not only clarifies your current financial position but also enhances your prospects for approval by addressing potential areas of improvement.

Empower your business with the insights needed to navigate the funding landscape effectively and access the capital essential for growth.

Securing funding can be a challenging process, but with our Business Funding Pre-Qualification Analysis, you’ll be well-prepared to navigate the path to approval. Our detailed analysis is designed to give you clarity and confidence, ensuring your business is truly funding-ready.

$249.99 Investment

( BNPL )

( Buy Now Pay Later Available if needed )

Why Choose Our Pre-Qualification Process?

Expert Insights:

Benefit from our industry knowledge , experience & expertise

Save Time & Resources:

Avoid the frustration of applying for funding without knowing your chances of success. Our analysis identifies gaps and strengths, so you only pursue opportunities you’re qualified for.

In-Depth Funding Analysis:

We evaluate your business’s financials, credit profile, business fico score and lender compliance with funding requirements,

giving you a clear picture of what lenders are looking for.

Maximize Your Approval Chances:

With a tailored action plan, we help you improve any areas that may be holding you back from securing funding, increasing your chances of success.

Take control of your funding journey.

Start your Pre-Qualification Funding Analysis today to secure the capital your business needs to grow.

MEET THE CEO

Mrs. Evanna K

Mrs. Evanna K is a seasoned entrepreneur and Business & Financial Strategist with over a decade of experience in the business world.

She holds a prestigious Harvard Business certification in Entrepreneurial Essentials, Business & Finance, and is a Board Certified Credit Consultant.

As the Founder and CEO of Realistic Linx Funding, a fintech company specializing in business finance,

Mrs. Evanna K is dedicated to driving the company's mission to provide strategic funding solutions that enable entrepreneurs and small business owners to achieve scalable growth and long-term success.

Under her leadership, Realistic Linx Funding connects clients with over 100 lenders while also facilitating optimal financial instruments and capital, with funding options available in as little as 24 hours

Mrs. Evanna K's leadership focuses on crafting and scaling strategic initiatives that align with the needs of businesses seeking funding. She ensures that Realistic Linx Funding remains at the forefront of providing innovative funding solutions, supporting businesses at every stage of their growth. Her strategic oversight is key to shaping the company's approach to business growth, optimizing client opportunities, and positioning them for greater financial success.

With a commitment to sustainable growth, profitability, and long-term impact, Mrs. Evanna K leads the company with purpose and dedication. She ensures that Realistic Linx Funding continues to evolve, meeting the changing needs of entrepreneurs and business owners. Through visionary leadership, she fosters a culture that helps clients unlock their full potential.

Additionally, Mrs. Evanna K is passionate about financial literacy within the community, aiming to help individuals attain financial freedom through education, coaching and strategic development.

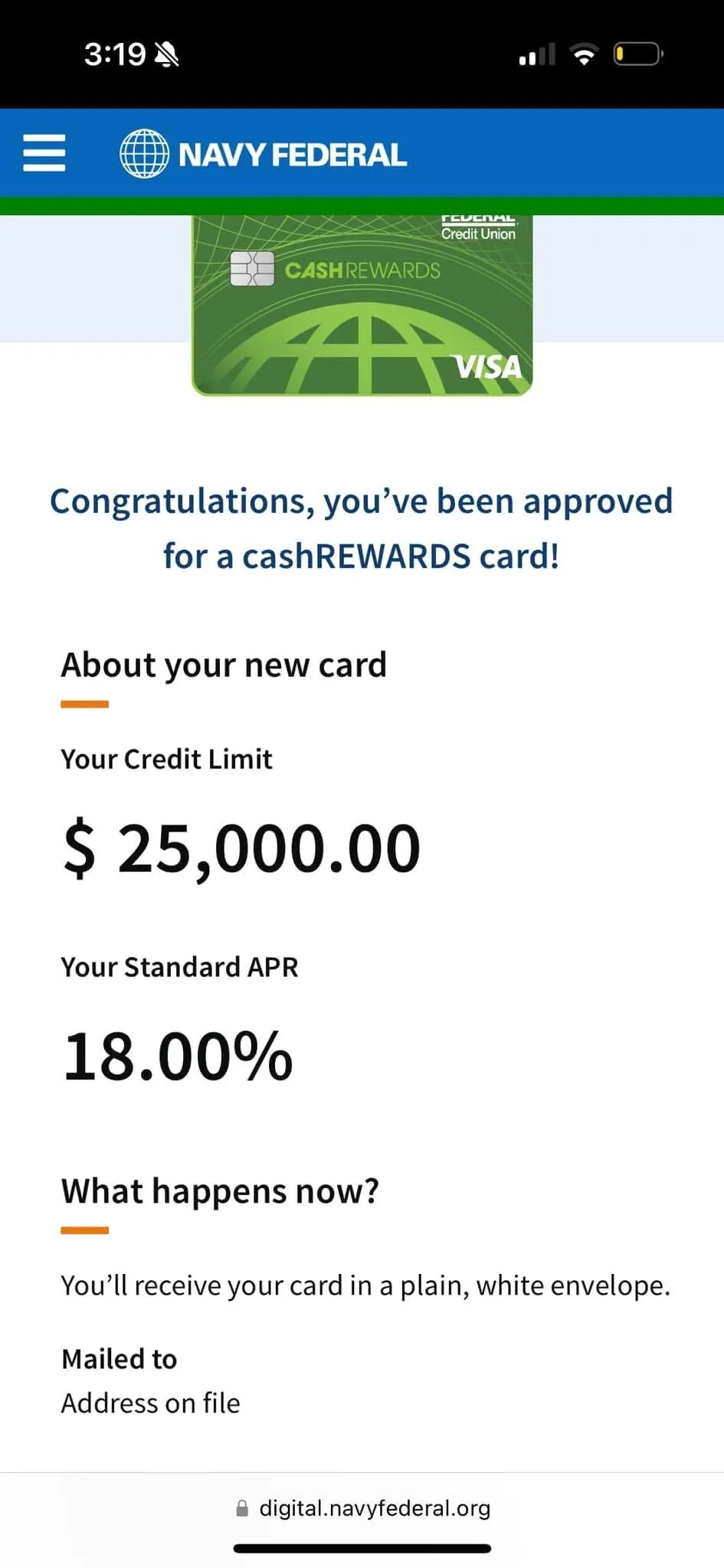

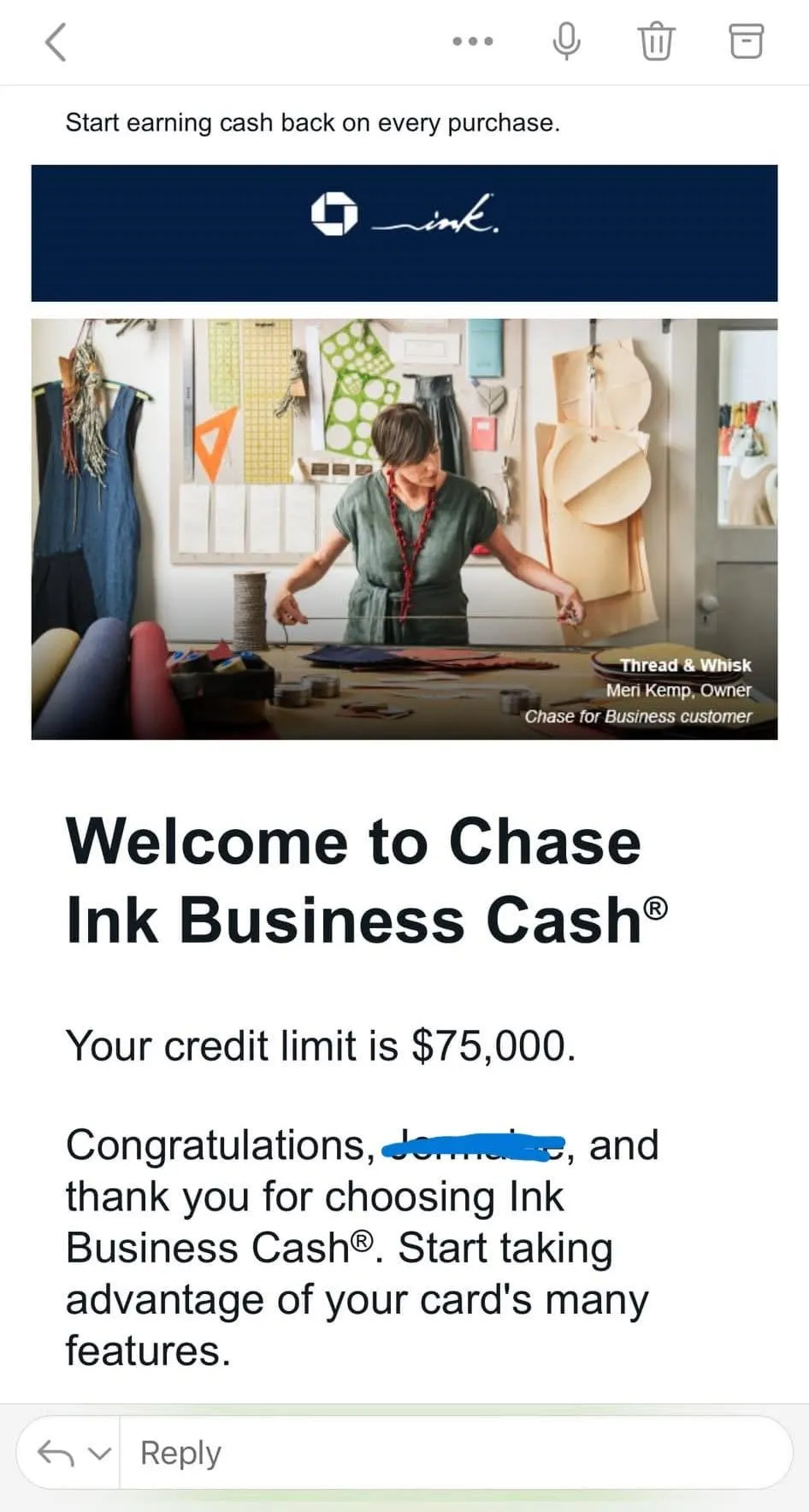

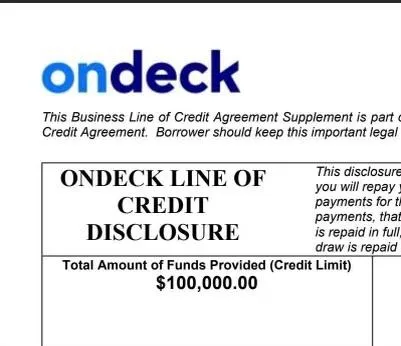

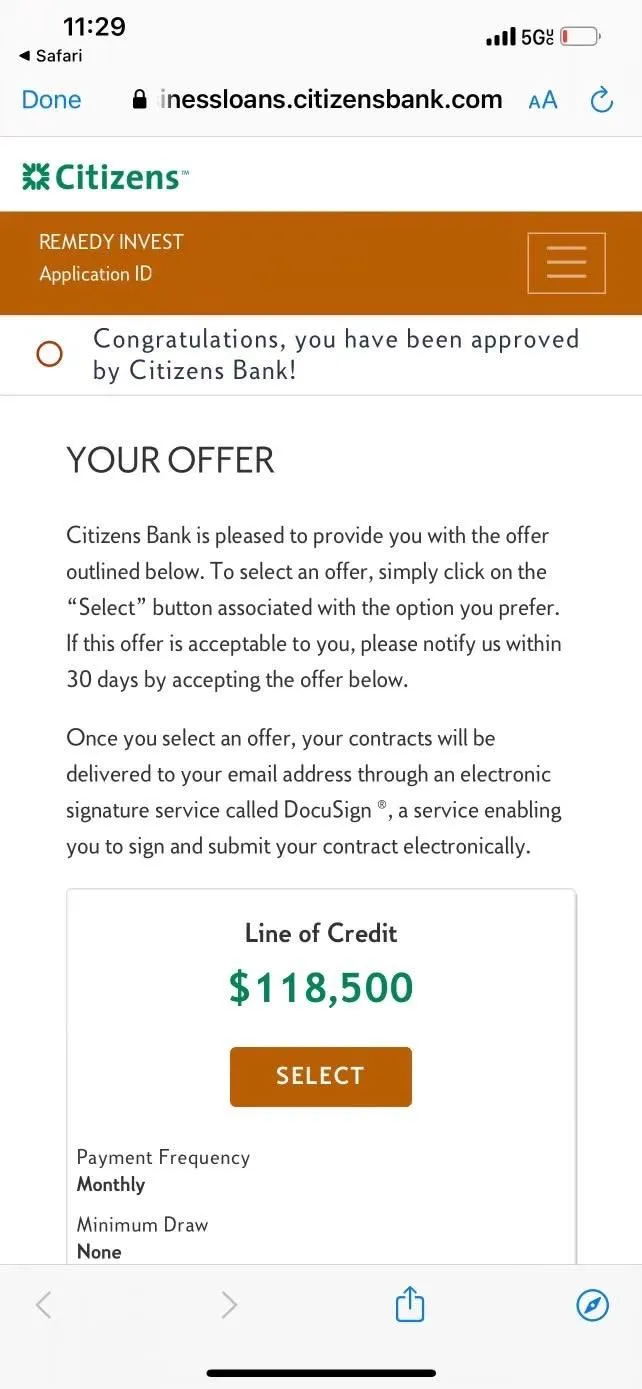

Client Business Funding Results

$25,000

$75,000

$100,000

$118,500

Business Funding

Pre- Qualification Analysis

What is this ?

Business funding pre-qualification analysis is a preliminary assessment process that helps determine whether a business is likely to meet the eligibility criteria for obtaining funding. It allows both the business seeking funding and the funding consultant to assess the potential fit with the financial product before proceeding with a application. Pre-qualification analysis is a crucial evaluation process & a important step in the funding process as it helps save time and effort by focusing on opportunities that aligns with the applicant & lender's criteria..

The process :

Initial Information Gathering: The business provides basic information about itself, including its industry, years in operation, revenue, and funding needs.Eligibility Assessment: The funding provider reviews the information provided by the business and checks whether it meets the initial eligibility requirements. This could include factors like credit score, time in business, and annual revenue.Initial Offer: If the business meets the initial criteria, the funding provider may provide a preliminary funding offer, including estimated terms and rates. This gives the business an idea of what kind of funding it might qualify for.

Benefits of Business Funding

Pre-Qualification Analysis:

Time-Saving: Pre-qualification helps businesses avoid set backs & denials that they wouldn't normally know what & if they meet the funding & underwriting requirements for approvals.

Focused Process: To review & assess whether your business is ready to secure funding. The focus & goal is to help identify potential issues early, improving your chances of securing the right funding options.

Clarity: Businesses gain a better understanding & clarity of their potential funding options and can make informed decisions about pursuing financing based on the funding analysis.

Flexibility: The flexibility of the pre-qualification process and business funding analysis lies in, Tailored Assessments, Diverse Financial & Credit Data Review, Customized Recommendations, Reduced Risk

No Credit Impact:

Pre-qualification involves no hard inquiry, no impact on the business owner credit scores.

Disclaimer: that pre-qualification business funding analysis does not guarantee funding. It' is a way to assess your initial eligibility to see if your business is qualified to meet the lenders & underwriters requirements & terms. Once a business has went through the pre-qualification process, we can proceed with the funding program options to get funding ready.

Our Funding programs focus on providing entrepreneurs & small businesses with the knowledge, financial & funding resources they need to achieve their business goals, secure funding, grow & scale.

Realistic Linx Enterprise LLC Copyright 2025